Insurance for hazardous goods transportation

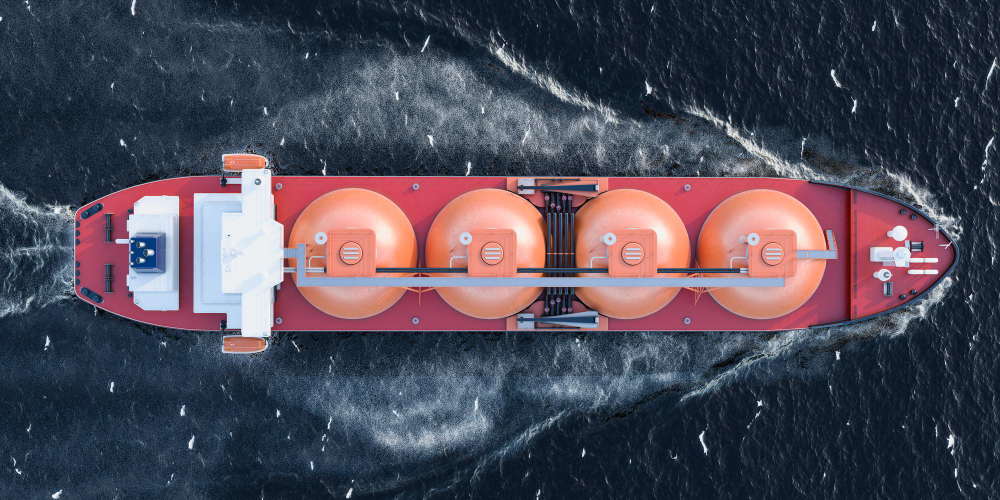

Transporting hazardous goods is a high-risk activity that requires additional safety measures. Accidents during the transport of these goods can have serious consequences for people, the environment, and the companies involved. That’s why it’s important for companies that engage in the transportation of hazardous goods to consider purchasing specialized insurance.

In this article, we will explore the different types of insurance for hazardous goods, the risks involved, and the companies that offer coverage.

Risks Associated with the Transport of Hazardous Goods

Hazardous goods are products that, due to their characteristics, can pose a danger to health, safety, and the environment during transport. These products include chemicals, gases, flammable liquids, explosives, and radioactive materials.

The transport of these goods presents a range of risks, such as traffic accidents, fires, explosions, and spills. In addition, the transport of these goods may involve the violation of regulations and standards, which can result in sanctions and fines.

Types of Insurance

There are several types of insurance, each designed to protect different aspects of the transport operation. Some of the most common types of insurance are:

- Carrier’s Liability Insurance: This insurance covers the costs associated with injuries or damage to third-party property caused by the transport of hazardous goods.

- Cargo Liability Insurance: This insurance covers damage to hazardous goods during transport.

- Pollution Insurance: This insurance covers the costs associated with cleaning up and disposing of hazardous substances in the event of spills or leaks during transport.

- Business Interruption Insurance: This insurance covers lost income and operating costs in the event of business interruption due to covered events such as transport accidents.

Insurance Companies for Hazardous Goods

There are several insurance companies that offer this type of insurance, each with different levels of coverage and prices. Some of the most popular companies are:

- AIG: esta compañía ofrece seguros de responsabilidad civil del transportista y seguros de responsabilidad civil de carga.

- Zurich: esta compañía ofrece seguros de contaminación y seguros de responsabilidad civil del transportista.

- Chubb: esta compañía ofrece una amplia gama de seguros para mercancías peligrosas, incluyendo seguros de responsabilidad civil del transportista, seguros de responsabilidad civil de carga y seguros de contaminación.

Transporting hazardous goods presents significant risks, and companies engaged in this activity should consider the possibility of purchasing specialized insurance to protect their business and the people involved in the operation. When considering the possibility of purchasing insurance, it’s important to understand the different types of insurance available and find an insurance company that offers adequate coverage for your needs.