The emergence of insurance in America

Insurance has been an integral part of the American economy since its inception. The history of insurance in the United States dates back to colonial times and has evolved over centuries to become the industry it is today.

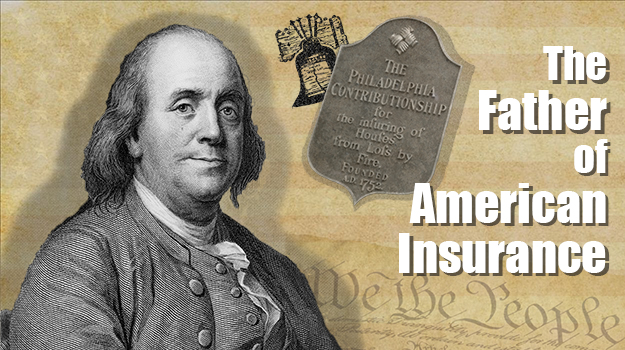

Early insurance companies

The first known insurance company in America was the “Philadelphia Contributionship for the Insurance of Houses from Loss by Fire,” founded in 1752. The company provided fire protection to homeowners and merchants. Other insurance companies were founded in the years following, including the “Insurance Company of North America” in 1792, the country’s first marine insurance company.

The era of railroads

With the advent of railroads in the 19th century, there was an increase in the need for insurance to protect railroad owners and their passengers. In 1864, the “Travelers Insurance Company” was founded to provide life insurance to railroad travelers. Over time, the company expanded its offerings to include accident insurance, property insurance, and other products.

The Insurance Law of 1868

In 1868, the New York Insurance Law was passed, establishing state regulation of the insurance industry. The law was a major milestone in the history of insurance in the United States, as it created a regulatory framework that protected consumers and established standards for insurance companies.

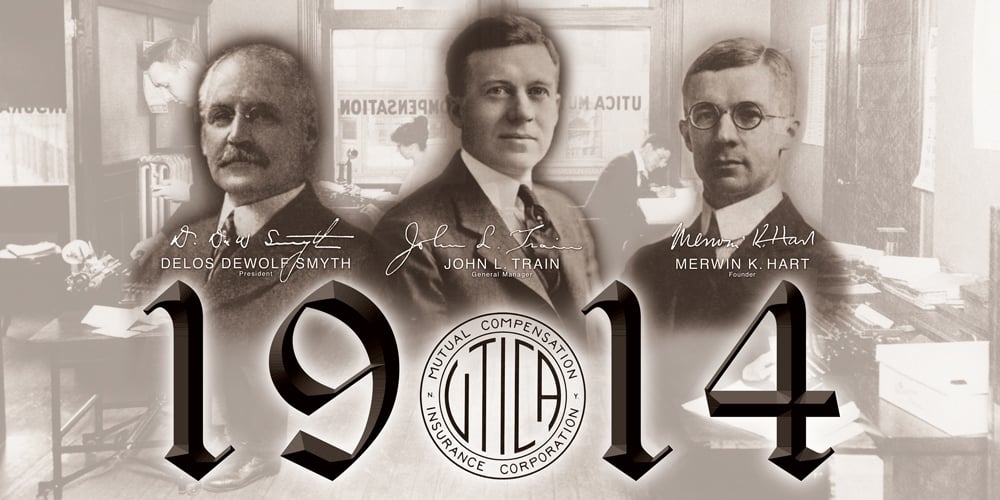

Modern insurance

In the early 20th century, the insurance industry expanded to include automobile insurance, health insurance, and liability insurance. In 1914, the “Insurance Information Institute” was founded to provide information about insurance to the public and educate consumers on the importance of insurance.

Insurance today

Today, the insurance industry is an important part of the American economy, with thousands of companies offering a wide variety of insurance products. The sector has expanded to include insurance for virtually every need, from life and health insurance to cybersecurity insurance.

In summary

The history of insurance in the United States is a story of evolution and adaptation. From the early insurance companies that provided fire protection to the modern companies that offer insurance for virtually every need, insurance has evolved to become an integral part of the American economy and a valuable tool for protecting people and their assets.